March 7, 2023

March 7, 2023

Prior to 2019, authentication used to only occur in rare situations, such as when a transaction was required as “high risk”. 2022 saw the deadline for the implementation of Strong Customer Authentication (SCA). SCA must be used whenever a Customer Initiated Transaction (CIT) takes place.

What is SCA?

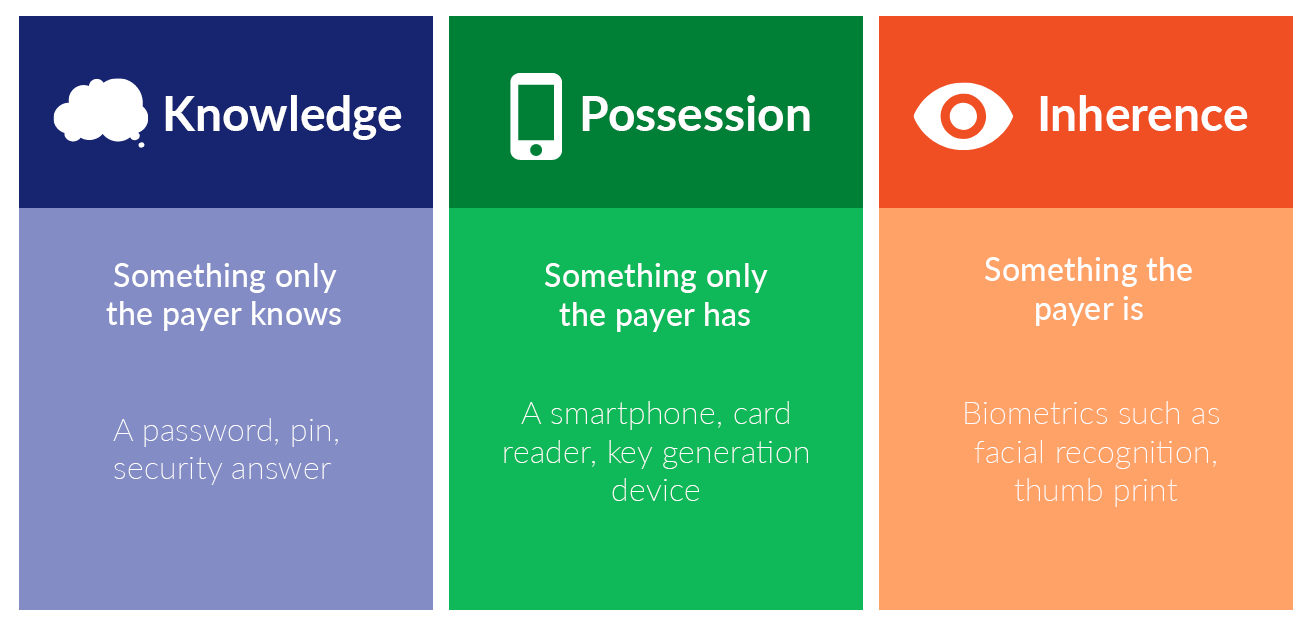

SCA is a way of proving the identity of a cardholder during an online transaction. It requires at least two of the following from the consumer:

In most cases when there is an online transaction using a debit or credit card, SCA is achieved using 3-D Secure (3DS). During these transactions, a cardholder is asked to provide proof of their identity by entering a unique password, SMS code, or a temporary PIN.

Why Was SCA Implemented?

It’s no secret that technology is developing at an exponential rate. The payments industry is experiencing a huge surge in the number of online payments and transactions. This increase has created more opportunities for cybercriminals and therefore a higher risk of fraud.

The EEA wanted to address these issues and ensure that there were steps in place to protect both Merchants and consumers.

What’s Next for Strong Customer Authentication?

Merchants should be encouraged to maximise their growth and embrace positive change in order to increase market shares. With EMV 3-D Secure 2.3 being implemented in the second half of 2023, SCA will become even more secure.

If you want to look at employing Pay by Bank App for your Merchants, or to learn more about how Cardstream can help you maximise your payments, click here for more information.

Stay up to date with all the latest news from Cardstream by joining our mailing list here.