March 29, 2022

March 29, 2022

3DSv1 vs 3DSv2

The Need for 3DS

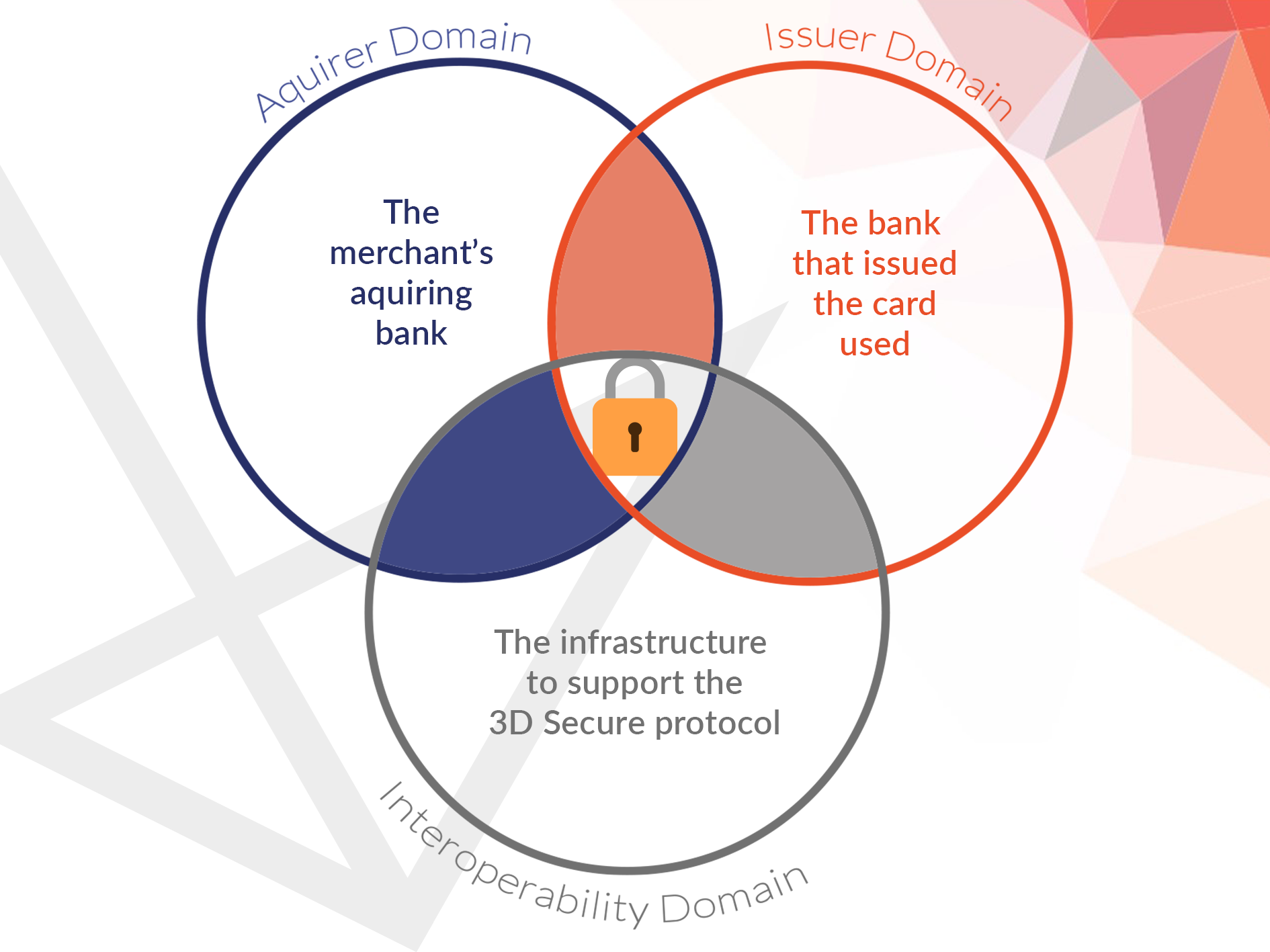

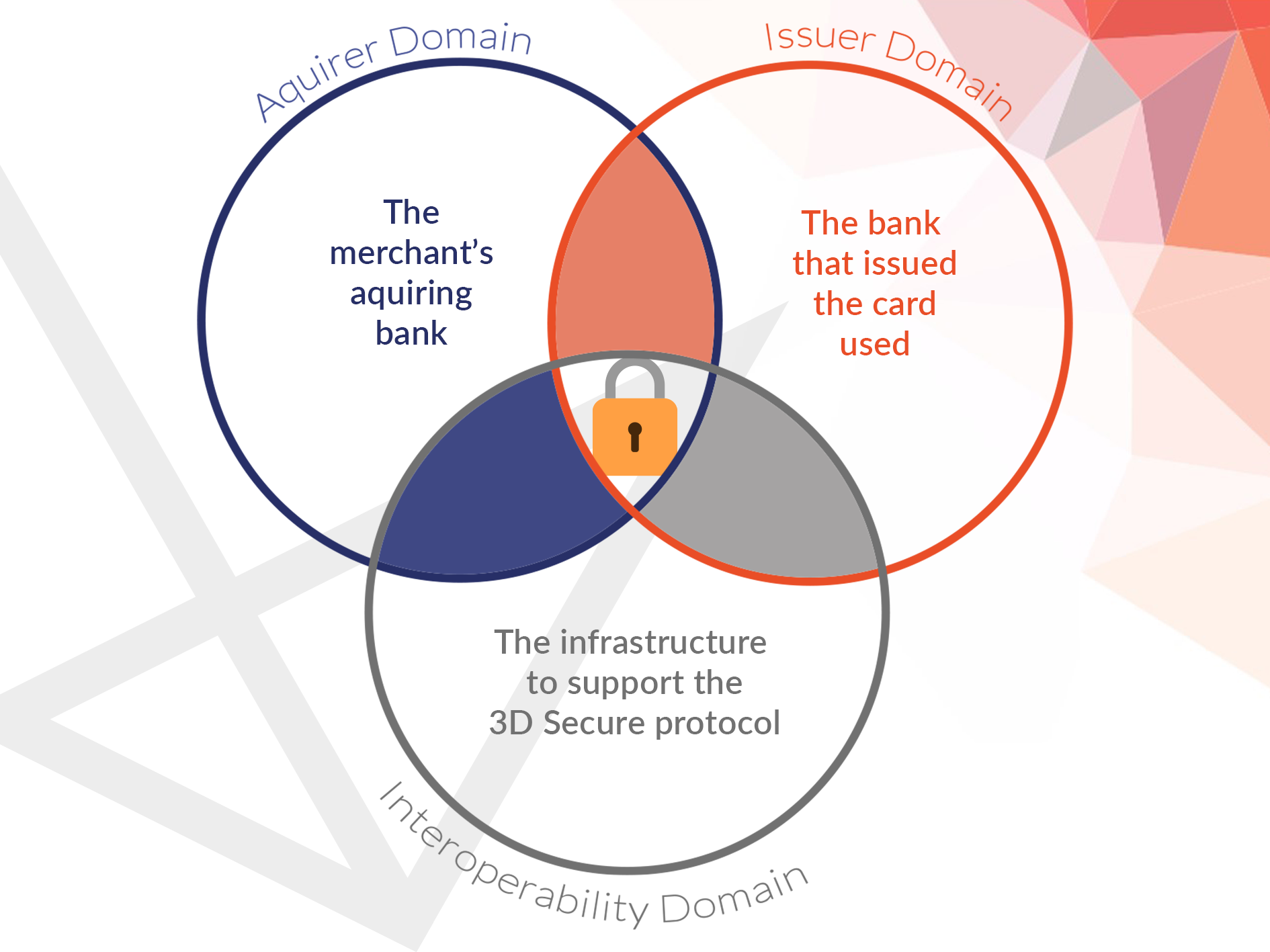

3-Domain Secure (3DS) is a way of completing Strong Customer Authentication (SCA), a requirement of online payment transactions within the EEA. When a cardholder makes a payment online, 3DS technology gauges if further identity verification is needed.

Developed by Visa, 3DS acts as a way to decrease the risk of fraud. With an increase in cybercrime since the pandemic, a secure authentication process is not only a legal requirement but a way to safeguard merchants from fraudulent transactions.

But, what are the 3 domains?

About 3DSv1

The first version of 3-D Secure was developed and released over 10 years ago, and it was unintuitive.

- Some users were unable to view their 3DS authentication page; with many compatibility issues when the process occurred in a mobile browser.

- Transaction rates declined as consumers found the process arduous and would often abandon the purchase when the 3DS page loaded slowly.

- E-Commerce websites sometimes caused suspicion among users when the 3DS pop-up occurred as it would not fit the brand or website’s aesthetic. This would result in an abandoned transaction.

How is 3DSv2 More Effective?

3DSv2 was first released in 2021 and with it saw a vast improvement in user experience.

- Frictionless Transactions – Performing an authentication step in the access control server (ACS), a card issuer is able to approve a transaction without the need for the cardholder’s authorisation. This frictionless authentication allows transactions to occur quicker and smoother.

- Mobile Integration – With smartphones and tablets becoming an integral part of our lives, an integrated 3DSv2 process for mobile payment processing is essential. Merchants can integrate a 3DSv2 process into their apps, making the customer’s checkout experience fast and efficient.

- Non-Payment Authentication – You can use 3DSv2 for more than ecommerce transactions. The introduction of “non-payment authentication” can authenticate a cardholder without them having to make a purchase. With successful authentication, their card details can be added to an e-wallet without the need of another authentication request at checkout.

March 29, 2022

March 29, 2022