September 19, 2025

September 19, 2025

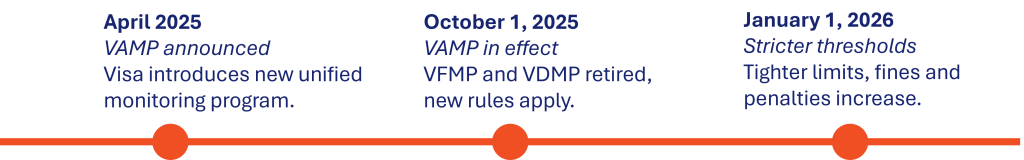

Visa’s Acquirer Monitoring Program (VAMP) will come into effect on October 1, 2025, changing how fraud and disputes are monitored across the payment ecosystem. VAMP will replace the existing Visa Fraud Monitoring Program (VFMP) and Visa Dispute Monitoring Program (VDMP) with a single, unified framework.

Under the new rules, Merchants who exceed Visa’s thresholds will face automatic fines, while Acquirers risk portfolio-level penalties if their Merchants are consistently non-compliant. Stricter thresholds will follow on January 1, 2026, making early preparation essential.

You can read Visa’s official announcement here: Introducing the Visa Acquirer Monitoring Program (VAMP).

What Is VAMP?

VAMP introduces stricter monitoring of fraud and disputes to improve security across the Visa network. The key changes include:

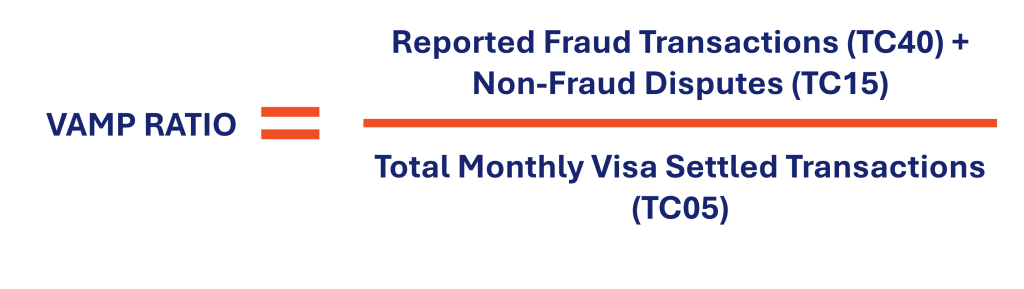

A key feature of VAMP is that performance will be measured using fraud and dispute ratios. The calculation is straightforward: the VAMP ratio is the total number of TC40 fraud transactions plus TC15 non-fraud disputes, divided by the total monthly number of settled Visa transactions:

This means both fraud and non-fraud disputes now count toward compliance thresholds, not just confirmed fraud. Even small increases in customer service issues or chargebacks could push a Merchant over Visa’s limits.

You can view the full breakdown of ratios and thresholds in Visa’s official VAMP Fact Sheet (PDF).

Why VAMP Matters

These changes mean:

How Cardstream Helps Partners and Merchants Prepare

Cardstream provides a suite of built-in fraud prevention tools within its Payment Gateway and Merchant Management System (MMS), as well as an advanced third-party integration with Kount, an AI-powered fraud solution. These tools allow both Partners and Merchants to strengthen their defences ahead of Visa’s new rules.

Built-in Fraud Monitoring Tools

Available to all Merchants via the MMS, Cardstream’s standard fraud checks are designed to give direct control over risk management:

AI-powered Fraud Protection with Kount

For Merchants requiring more advanced protection, Cardstream offers integration with Kount, a market-leading fraud prevention solution powered by AI and machine learning. Kount’s features are especially valuable under VAMP because they directly target the areas Visa will monitor.

By combining built-in MMS checks with Kount’s advanced analytics and prevention tools, Merchants and Partners gain both control and foresight, which are essential under VAMP’s stricter framework.

What Partners Should Do Now

What Merchants Should Do Now

Preparing for VAMP with Cardstream

With enforcement set to begin in October 2025, Partners and Merchants should act swiftly. By combining Cardstream’s built-in fraud tools with Kount’s AI-driven protection, Merchants and Partners can significantly reduce fraud and dispute levels, ensuring they remain compliant under Visa’s stricter rules.

Cardstream provides the visibility, flexibility, and protection needed to help safeguard against VAMP penalties.

If you have any questions or would like to explore how Cardstream’s tools can further strengthen your fraud prevention efforts, please contact your Relationship Manager or our Support Team.