May 26, 2022

May 26, 2022

Ten years ago, the idea of being able to pay directly from your phone with just a tap seemed more StarTrek than FinTech. The payment industry has undergone a major revolution, and with this comes new ways fraudsters can intercept secure data. Ensuring you keep digital wallets secure is vital for your business.

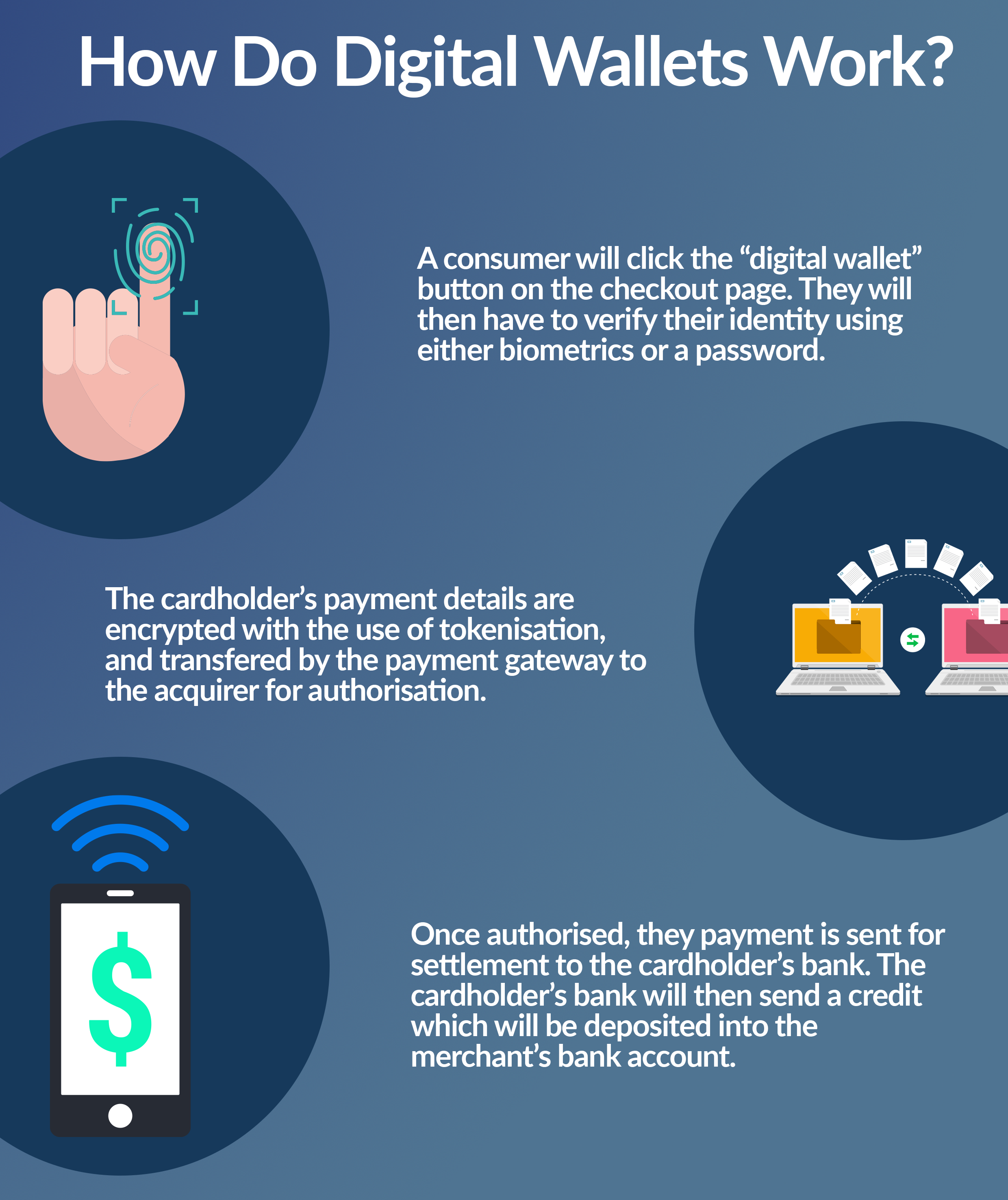

A digital wallet is a software-based system that securely stores users’ payment information and passwords for numerous payment options.

A digital wallet operates by using software to link the wallet (usually in the form of an app) to payment details from the consumer’s bank. Apple Pay, Google Pay, and Samsung Pay are all example of digital wallets.

In a world that seems to be constantly speeding up, providing a quick and easy solution is essential. Consumers want to be able to check out anytime, anywhere, and a merchant who can offer a digital wallet payment method will reap the benefits of this tech boom.

Using a digital wallet can offer many benefits, both for merchants and consumers.

Ensuring you can accept payments securely will not only boost your revenue, but it will also increase your brand’s trust. There are steps you can take to ensure payments are being taken securely .

Cardstream’s Gateway supports an internal digital wallet that is available to all Merchants using the Gateway. The Gateway allows you to store customers’ payment card, billing and delivery address, and other billing information encrypted in its internal wallet. You can then allow your customer to select from one of their stored payment cards to check out faster on your website.