March 7, 2023

March 7, 2023

Prior to 2019, authentication used to only occur in rare situations, such as when a transaction was required as “high risk”. 2022 saw the deadline for the implementation of Strong ....

February 28, 2023

February 28, 2023

In the FinTech industry, the terms E-Commerce and M-Commerce are thrown around a lot. But what do these terms mean? Can they be used interchangeably? E-Commerce is an umbrella term ....

February 22, 2023

February 22, 2023

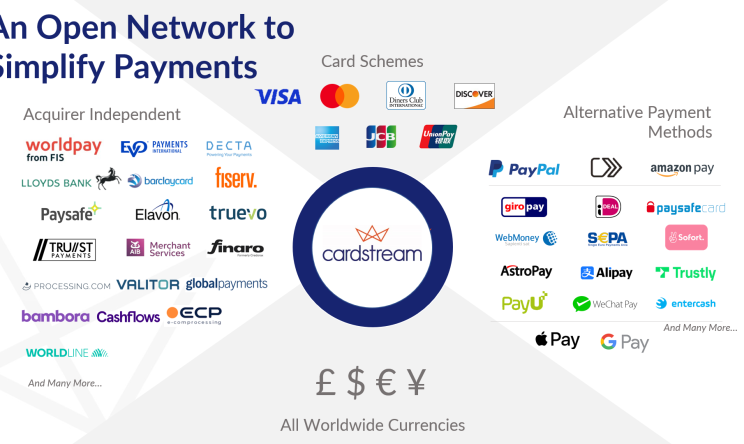

Cardstream’s Open®Payment Network (OPN®) offers a collection of Acquirers, Alternative Payment Methods (APMs), fraud solutions and payment integrators – all available via a single API. The Open®Payment Network is purposely ....

February 15, 2023

February 15, 2023

You may have seen that Pay by Bank App is becoming a more prominent way consumers choose to pay, but what is it? Brought to market by Mastercard, Pay by ....

February 6, 2023

February 6, 2023

One of the most important decisions a Merchant can make when establishing their E-Commerce business is which Payment Gateway Solution they should utilise. Acting as the channel between the E-Commerce ....

January 17, 2023

January 17, 2023

Address Verification Service Checks, also known as AVS Checks, is one of the most widely used fraud prevention tools when a card-not-present transaction occurs. How Do AVS Checks Work? AVS ....

January 9, 2023

January 9, 2023

The Third Monday of the year is commonly known as “Blue Monday”. This may be accompanied by media stories sensationalising the day, but what is Blue Monday and what does ....

January 3, 2023

January 3, 2023

The payments industry is ever-changing and hard to predict, but what can be expected for payments in 2023? Buy Now Pay Later One of the biggest trends of 2022 has ....

December 20, 2022

December 20, 2022

2022 is coming to an end, and now is the perfect time to take a look back at what has happened within the payments industry this year. Interchange Price Changes ....

December 13, 2022

December 13, 2022

A soft decline occurs when a customer’s issuing bank is willing to approve a transaction but not in its current state. Of all declines, roughly 85% can be deemed as ....